The Greater Tokyo Biocommunity (GTB) was established in October 2021 to strengthen the bioindustry ecosystem and achieve the goal of “realizing the world’s most advanced bioeconomy society by 2030,” as stated in the national government’s “Bioeconomy Strategy 2020“. GTB promotes the formation of a global biocommunity hub in Tokyo and its surrounding areas (hereafter referred to as the “greater Tokyo area”), with the participation of a total of 45 organizations including local governments, universities, research institutes, bio-related organizations, industry support organizations, and financial and investment institutions. In April of this year, the GTB received accreditation as a global bio-community from the national government, and is on the verge of accelerating its efforts even more.

In this article, we explain the potential held by the greater Tokyo area as well as GTB’s efforts toward further development with using some market data researched by Ministry of Economy, Trade and Industry.

Extensive Research Results by Academia

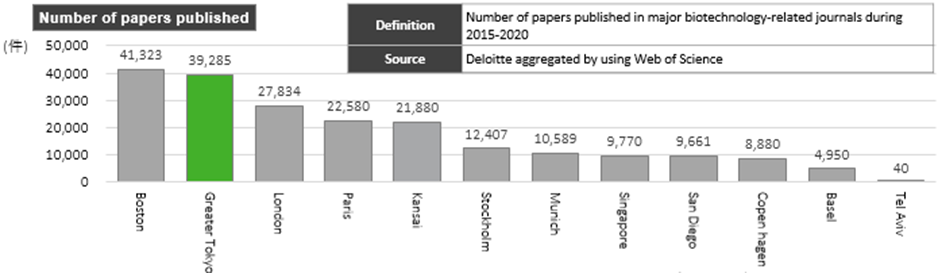

GTB covers a wide area around central Tokyo; this area is home to many world-class universities and research institutes conducting research on seeds for new technologies. A survey of the number of papers published, one of the indicators used to evaluate the level of research in academia, and a comparison against the 10 cities with major bio-communities overseas shows that the greater Tokyo area ranks high. This indicates that there is a rich research environment generating many research results and development pipelines.

For example, in terms of the number of papers published in major biotechnology-related journals during 2015-2020*[1] the greater Tokyo area (Tokyo Metropolis, Kanagawa Prefecture, Chiba Prefecture, Saitama Prefecture, Ibaraki Prefecture) had 39,285 papers published, which is comparable with the number for the leader, Boston (Figure 1).

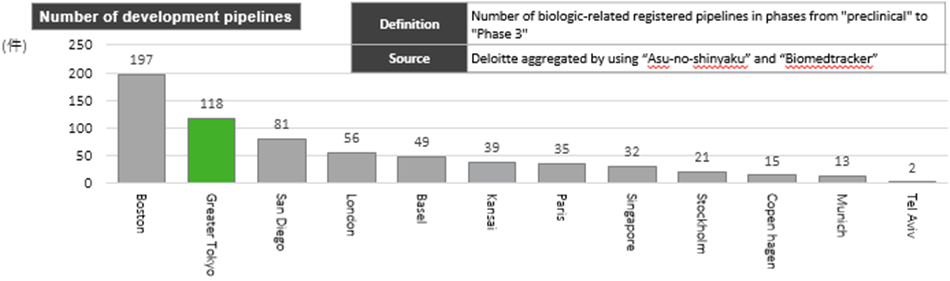

In addition, the concentration of pharmaceutical and startup companies in the greater Tokyo area has created a large number development pipelines, even when viewed from a global perspective. According to the database for investigational agents, “Asu-no-shinyaku,” when compared in terms of the number of biologic-related registered pipelines*[2] in phases from “preclinical” to “Phase 3,” the greater Tokyo area has the second largest pipeline developed following the leader, Boston. In particular, Tokyo Metropolis leads the number of pipelines in the Tokyo metropolitan area as the location of major pharmaceutical companies such as Chugai Pharmaceutical, Daiichi Sankyo, Astellas Pharma and Takeda Pharmaceutical Company.

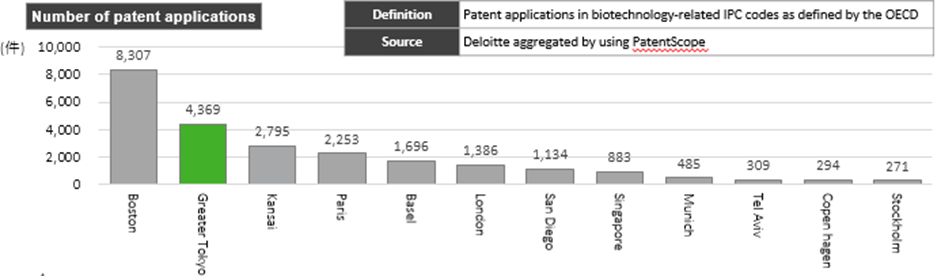

The greater Tokyo area is also at the top globally in terms of patent applications. A survey of the number of patent applications between 2015 and 2020 shows that, while the numbers are slightly lower than leader Boston, the greater Tokyo area is in second place*[3], indicating the area’s high technological capability (Figure 2).

High Concentration of Major Companies and Startups

In addition to universities and research institutes, the greater Tokyo area is home to many major companies as well as biotech startup companies. The high concentration of startups in the Tokyo area can also be seen in the fact that the total sales of companies that are members of the five biotech-related organizations in the greater Tokyo area reached total sales of more than 100 trillion yen in 2020. These companies have also created a number of distinctive biotech products that can compete globally in pharmaceuticals, agriculture, chemicals, and other fields.

Although the biotech ecosystem is still developing compared to the world’s major bio-communities, there have been leading efforts by variety of startup companies, not only in pharmaceuticals but also in agriculture and the environment, which have also resulted in numerous success stories.

Promoting Innovation

Hubs for promoting innovation are being formed around eight areas in the greater Tokyo area: Tsukuba, Kashiwanoha, Hongo/Ochanomizu/Tokyo Station, Nihonbashi, Kawasaki, Yokohama, Shonan, and Chiba/Kazusa. Each area activates collaboration between industries, academic and government to promote innovation.

By clarifying the value chain of each center and improving its functions, the greater Tokyo area will build a one-stop system for the entire region enabling everything from research and development to commercialization, thereby creating even greater results.

Future GTB Initiatives

GTB’s objective is to build a framework to effectively transfer promising technological seeds created at universities and research institutes to startup companies and smoothly implement them. GTB aims to broaden its scope to achieve further development and build an ecosystem that ranks with leading overseas bio-communities.

[1] The number of journals covered was 1021. The top 10 main subject categories were: Biochemistry & Molecular Biology, Cell Biology, Biotechnology & Applied Microbiology, Microbiology, Oncology, Immunology, Environmental Sciences & Ecology, Biophysics, Infectious Diseases, and Virology

[2] Out of the “Drug potency 87” (Japanese Standard Commodity Classification No. 87) pharmaceutical formulations in the “Asu-no-shinyaku”, the pipelines registered as “620 Biologics”, “629 Other Biologics”, “613 Biologics (anti-infectives)” and “623 Biosimilars” were aggregated. Biomedtracker (“Biomedtracker® | Informa, 2021-July) was referred for US.

[3] Patent applications in biotechnology-related IPC codes as defined by the OECD were aggregated, not limited to PCT applications. Application dates covered January 1, 2015 through December 31, 2020.